Impact Of Subsidies

Abstraction

About every state provides subsidies to agriculture sector in different signifier. But inquiry is how much they are good to agriculture sector. To happen out the reply of this inquiry we study how much subsides given in which state and what is its consequence on agribusiness production, Import, Export, Import cost, export gross etc. To mensurate the exact impact of subsidies in agribusiness sector is non a easy undertaking. The subsidies are truly good to agriculture sector across universe but it has some negative impact besides.

Introduction

There are different positions of agribusiness expert and economic expert sing subsidies. Harmonizing to agribusiness expert they are truly good but harmonizing to economic expert it is harmful it should cut down. Agribusiness subsidies are one of the hottest subject for argument in universe. From several old ages every state provide immense sum of subsidies for the development in agribusiness sector. And we find some sort of development took topographic point in agribusiness sector and we have tonss of cogent evidence for this growing. But now WTO attempts to cut down subsidies because it non full make full the aim of subsidies and it besides consequence other economic system.

Objective of subsidies

- Subsidies given by authorities to work out specific job.

- Subsidies used for the pattern that are non common with manufacturer or acceptance of new engineering.

- Once subsidies proven cost effectual so it should be removed.

Positive impact of subsidies

- Subsidies increase the productiveness of agricultural merchandise.

- Subsidies generate employment.

- Subsidies cut down the poorness.

- Implement of new engineering.

- Take out from hungriness.

Negative impact of subsidies

- Subsidies cut down planetary monetary values of harvest.

- More usage of pesticides which lead to dirty debasement, groundwater depletion and other negative impacts.

- Reduce fight.

- Trade distort.

- Effect poorness, nutrient security, and national security.

Under WTO agribusiness subsidies are grouped into three boxes Amber box subsidies: – All domestic support which non comes under bluish and green box subsidies are brownish-yellow box subsidies or we say it is trade falsifying. Blue box subsidies: – all domestic support which restricting the production. And green box subsidies-all domestic support which is non merchandise falsifying or minimum trade distorting.

In 2001, Doha unit of ammunition at universe trade administration many developing states including India, China, Brazil against the agribusiness subsidies given by developed state including US and EU. Developing state argues that immense sum of subsidies given by developed state driving down planetary harvest monetary value which is unfavorable to little husbandman in developing state and it maintain poverty in developing state.

Question is how much difference makes in last 13 old ages.

Shift of subsidies in developed states from gold box to green box between 1995-2010

There significant decrease in domestic support steps under gold and bluish box in developed state. Decline in AMS in all developed states compare to 1995. In US aggregative steps of support diminution to USD 4.1 billion in 2010 comparison to USD 6.2 billion in 1995. While this diminution to ˆ 6.5 billion from ˆ 50.1 billion. Lapp experienced in other developed state besides. But at the same clip it was shown that there is addition in green box subsidies is more than compensated in gold and bluish box subsidies. green box subsidies increased signifier USD 46 billion in 1995 to USD 120 billion in 2010 and it increases ˆ 9.2 billion to ˆ 68 billion in EU.

Maximum green box subsidies experienced by EU, the consequence shows that entire factor productiveness in agribusiness sector with subsidies is 8.3 % and without subsidies is 3.7 % per annum and on an norm it is 4.6 % while in US, with subsidies entire factor productiveness growing is 6.2 % , without subsidies 2.6 % and on an norm it is 3.9 per annum. This shows that over 13 old ages, agricultural productiveness increased by 51 % in US and 60 % in EU on an history of green box subsidies.

Consequence on subsidies in US and EU

In EU decoupled payment was 50 % of green box subsidies in 2007, hence cut of 50 % is applied to green box subsidies. And in US entire subsidies were about $ 76 billion of which 70 % were for nutrient cast. To retreat nutrient cast from green box subsidies there were cut of 30 % of entire green box subsidies can be applied and estimated nutrient cast support to agribusiness is 10 % therefore cut of 40 % green box subsidies in US.

Consequence of subsidies decrease in US and EU is shown in below tabular array

Above information is for the period of 2007-2010, with the aid of this information we are in a place to state that the cut in agribusiness subsidies in US and EU finally good for developing, less developed and Net nutrient importing state.

This cut lead to major curtailing agribusiness merchandise and trade production and exports displacement towards more competitory manufacturers in developing states.

The consequence shows that the production is fall by 5 % while import addition in developed state by 22 % where as in developing state export increased by 12 % and export gross addition by 17 % . It besides good for the LDCs, export volume is increased by 9 % and export gross is increased by 8 % and import autumn by 4 % . import volume of agribusiness merchandise addition in US by 67 % and in EU by 35 % along with import cost.

Consequence shows production and trade falsifying impact of green box subsidies is non minimum as even a cut of 40 % in US and 50 % in EU. This two state lead to increase in trade volume by 5 % and gross by 8 % and addition in export gross in developing state by 15 % and LDCs increase their import volume between 10 % -17 % even no addition in import cost.

capping of Green Box Subsidies at 2001 Level in EU and US

Capping of GB subsidies of USA and EU to 2001 degree, This shows the farther extension of trade deformation caused by green box subsidies in planetary agricultural production and agricultural trade station 2001. The green box subsidies in US increased from $ 50 billion in 2001 to $ 120 billion in 2010 while that of EU rose from $ 18 billion to $ 90 billion.

Capping is resulted in significant addition in net nutrient importing state ( NFIC ) , LDCs and developing state in term of agribusiness production and trade. Export gross addition by 32 % in LDCs and 55 % in developing state and moved toward more competitory manufacturer and it increase by 3 % -5 % in developing state. While in NFIC import cost diminution by 4 % , addition in agricultural production by 4 % and export gross addition by 81 % severally.

Agribusiness production falls in EU and US by 19 % and 15 % and agribusiness import rise by 85 % and 200 % severally while planetary agribusiness merchandise increased by 3 % , export volume and export gross increased by 17 % and 25 % severally. All developing state experienced with autumn in their import cost as production displacements to more competitory and lower cost manufacturers while imports of developed parts rise well. This indicates the extent of unreal fight created because of subsidies in developed states.

Current scenario

United province

Us section of agribusiness in 2012 spent about $ 14 sing husbandmans cope or income which is seven clip more than comparison to financial twelvemonth 2000 harmonizing to congressional Research service.

Which allow husbandmans to seting chancing harvest which has been marred by fraud and that illustrates whygovernment spendingis so hard to command.

Government approved 18 insurance companies to wages to run the programme The authorities pays husbandmans to purchase coverage and pays the measures if losingss exceed predetermined bounds which is good trade for everyone except taxpayer

PresidentBarack Obama sought this twelvemonth to cut about $ 12 billion from the plan over the following decennary while his ideological antonym, Republican House Budget Committee Chairman Paul Ryan, has called subsidized insurance “crony capitalism.”

European brotherhood

Possible reform and clip tabular array?

Number of trigger point are already set. Renegotiation of EU, s Multi-annul Financial Framework ( MFF ) for the period after 2020.The agenda for O.K.ing the current MFF gives us some thought what to anticipate.

The European council forwarded its meeting in 2012 to February 2013 which was forwarded by committee to the council and parliament in 2011 which left the This left sufficient clip for the Council and Parliament to make understanding by July 2013 to let the Parliament to give its consent to the new MFF which entered into force on 1 January 2014.

After the intensive dialogue, in 2013 trade was secured both on the CAP and the MFF. . The new CAP 2014-2020 agreed by the Council and the European Parliament retains most of the indispensable aims and attacks proposed by the Commission, albeit with a lower budget than proposed by the Commission.

CHALLENGES & A ; OBJECTIVES

The new CAP physiques on past reforms to run into new challenges and aims.

Since from 1992 with the aid of cap reforms which have increased market orientation for agribusiness while supplying income support and safety cyberspace mechanisms for manufacturers, improved the integrating of environmental demands and reinforced support for rural development across the EU.

The new policy continues along this reform way, traveling from merchandise to manufacturer support and now to a more land-based attack. This is in response to the challenges confronting the sector, many of which are driven by factors that are external to agriculture.

These have been identified as

- economic: – including nutrient security and globalization, a worsening rate of productiveness growing, monetary value volatility, force per unit areas on production costs due to high input monetary values and the deteriorating place of husbandmans in the nutrient supply concatenation.

- environmental: -relating to resource efficiency, dirt and H2O quality and menaces to home grounds and biodiversity.

- Territorial: – where rural countries are faced with demographic, economic and societal developments including depopulation and resettlement of concerns.

Since the function of the CAP is to supply a policy model that supports and encourages manufacturers to turn to these challenges while staying coherent with other EU policies, this translates into three long-run CAP aims: feasible nutrient production, sustainable direction of natural resources and climate action and balanced territorial development.

To accomplish these long-run ends, the bing CAP instruments had to be adapted. The reform hence focused on the operational aims of presenting more effectual policy instruments, designed to better the fight of the agricultural sector and its sustainability over the long term CAP BUDGET

Sums available for the new CAP

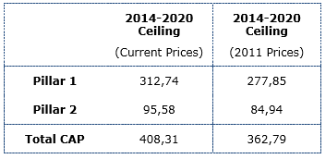

Under the new multiannual fiscal model ( MFF ) cap agreed the sum for 2014-2020 are outlined in the tabular array below

The Commission had proposed that, in nominal footings, the sums for both pillars of the CAP for 2014-2020 would be frozen at the degree of 2013. In existent footings CAP support will diminish compared to the current period. Compared to the Commission proposal, the sum for pillar 1 was cut by 1.8 % and for pillar 2 by 7.6 % ( in 2011 monetary values ) .

This means a entire sum of EUR 362.787 billion for 2014-2020, of which EUR 277.851 billion is foreseen for Direct Payments and market-related outgo ( Pillar 1 ) and EUR 84.936 billion for Rural Development ( Pillar 2 ) in 2011 monetary values. Yet, within the current economic and fiscal clime, these sums within the MFF show continued strong support for an ambitious agricultural policy which represents 37.8 % of the full ceiling for the period 2014-2020.

VOLUTION OF POLICY AND Spending

Cap outgo

In above chart shows the alteration in the orientation of the CAP is demonstrated by the development of outgo, repeating the policy displacement since 1992, off from merchandise based support towards manufacturer support and considerations for the environment.

Over 90 % of entire CAP outgo represented by market direction in 1992. And subsequently in 2013 it dropped to merely 5 % as market intercession has become a safety cyberspace tool for times of crisis and direct payments are the major beginning of support ; 94 % of which are decoupled from production.

From 2014 onwards, the allotment of direct payments dedicated to match support, immature husbandmans, little husbandmans, etc. will be depend upon the picks made by Member States.

New characteristic of the cap

- joint proviso of public and private goods

- efficient, targeted and consistent

- flexibleness

New design of direct payment

The public presentation of the CAP will besides profit from a more balanced, crystalline and more just distribution of direct payments among states and among husbandmans. The decrease in disparities of the degree of direct payments between Member States, known as external convergence, will reenforce the credibleness and legitimacy of the support system at EU degree.

The degree of direct payments per hectare, which is presently based on historic parametric quantities in many states, will be increasingly adjusted with the debut of a minimal national norm direct payment per hectare across all Member States by 2020.

The two pillars will besides interact in fiscal footings, with possible transportations between both and regulations to forestall double-funding.

Member State will necessitate to do certain that a possible transportation from the 2nd to the first pillar does non suppress a strong Rural Development policy in its district.

In add-on, for the first clip a common and consistent overall Europium policy model is established for all European Structural and Investment ( ESI ) financess including EAFRD10 to better co-ordination between them and beef up the complementarily of the different plans. To this terminal Member States will hold to fix Partnership Agreements, followed by the corresponding programmes, based on common precedences and marks set for 2020.

India

The authorities of India provides the finance to agriculture on subsidised rate for farming. It is helpful to husbandmans in India because in India near approximately 11 % of people are husbandmans & A ; in which 11 % most of husbandmans have land but does non hold sufficient finance for agriculture. Through subsidised finance husbandmans are making farming. Chiefly three types of finance are necessitating for agribusiness sector. i.e. Short term, Medium term & A ; Long term finance.

Long term recognition for the period of 5 – 20 old ages. In Agriculture, long-run investing comprises of droping good, land, fencing and lasting betterments on land purchase of large machinery like tractor with its fond regards including streetcars, constitution of fruit grove of Mangifera indica, Anacardium occidentale, coconut, orange, Punica granatum, fig, Psidium littorale, etc. It is provided through the nationalized bank. In average term finance largely include finance for farm equipment & A ; little machinery e.g. tractor, thrasher & A ; other equipments. In short term finance include harvest finance continuance of this finance is one twelvemonth to two old ages & A ; per centum of involvement is really low i.e. 2 % to 4 % . The bureaus provide finance to the agriculturists is Private bureaus: ( a ) money loaners and landlords ; ( B ) commercial Bankss. & A ; public or semi-public bureaus: ( a ) the State ; ( B ) co-operative societies

The above figures shows that the per centum of agribusiness finance in India is continuously increase & amp ; it positively affect on production of agribusiness goods in India

Production

The India is one of the major manufacturers of agribusiness goods in universe. As per of different geographical country assorted harvests yield in India. India holds the 2nd place in production of wheat, rice, cotton, sugar cane, and Indian potatos. It is besides the 2nd biggest reaper of veggies and fruit, stand foring 8.6 % and 10.9 % of the overall veggie and fruit production in the universe correspondingly.

The agribusiness production in India is continuously additions in last year’s. In twelvemonth 2007-08 the gross one-year production of all harvests is 973.27 million metric tons & A ; in twelvemonth 2012-13 is 1010.95 million metric tons. As we compare the tabular array no.1 & A ; 2 we easy found that sum of subsidies is addition at same clip production degree of agribusiness goods besides increases. It shows that subsidies help to increase agribusiness productiveness.

decision

Since from last 12 old ages, after Doha round it was shown that the agribusiness subsidies given by BRIIC state was increase well. $ 160bn agribusiness subsidies estimated by china’s in 2012 which decreases in US to $ 19bn and EU to $ 67b combined. Which is dual in three old ages in Brazil. And now entire about $ 10bn harmonizing to a recent authorities study.Where as in India monetary value support for wheat and rice grew by 72 % and 75 % significantly between 2005-06 and 2010-11 significantly those in US.

It was besides shown the abuse of subsidies in developing and developed state like India, EU, US etc. for illustration Indian authorities provide subsidies on the cost of energy to pump H2O for agribusiness sector, which encourage manufacturer to pump more H2O than they need. This has made Indian manufacturers among the world’s least efficient H2O users. So we need to look at this. Because there is tonss of positive and negative impact of subsidies.